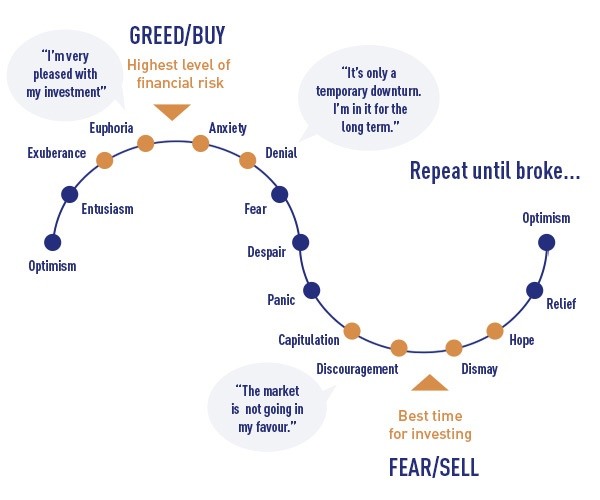

The psychological and emotional state of users is an important factor affecting the amount of investment. If the investor enters a position with only the hope of gain and fear of loss or in an uneasy state, the probability of loss is very high, no matter how perfect the investment strategy. Focusing on success psychologically is actually the main factor for success.

If you want to make good earnings, if you prepare for it psychologically, you will increase your chances of success.

What really sets an investor apart from other investor people is their psychology.

In the first moments when you try to evaluate your money, you have seen or will see with your own eyes how much psychology is related to investing. While training and practical deficiencies, which are other factors that may cause losses, can be developed and resolved; psychology cannot be developed that easily and requires awareness. Now we will talk about some psychological dangers that you should be aware of when investing. Developing awareness about these dangers will increase your chances of earning on your investment.

We have compiled some tips for you to feel more psychologically stable while trading binary options on Exbina.

Rule #1: Realize What You Know

A focused investor is well aware of the financial statements and footnotes of the company he invests in. He has information about the company and the sector it is in. He has realistic estimations regarding the growth of the economy. It has followed the news about the company and its price movements are ahead of it. So this investor is aware of what he knows. He is also aware that he does not know how the prices will move from now on.

Rule 2: Be Aware of the Changing Market

The focused investor sees that the index suddenly changes direction on the screen while following his/her transaction. All shares, including the shares in which he has invested, are sold. He starts to scan the news and ask questions to someone to see if there is a news or what happened. The stock market has started to decline. Meanwhile, Europe has also turned red. While the Frankfurt DAX index is upside down, the Paris and London indices are also decreasing. US markets have not been opened yet. Bad news comes one after another. The situation is getting more and more hopeless. The investor gets bored and starts to sweat. The panicked investor starts selling after watching the market and the news for a while. And now he is relieved…

Rule 3: Observe and Investigate

Positive news comes to the screens. The stock market is now closed. The next day, he takes a look and the markets open with a plus. The shares he sold start the day at a price higher than he sold at the opening. The analysis about the company has not changed. The value of the shares is still cheaper than the calculations made.

So what happened so that the investor went on sale? What is unknown here?

In fact, what he does not know is right in front of his eyes. Because of his genetic inheritance, his brain makes decisions with preconceptions. So, "Modern Portfolio Theory"

Modern Portfolio Theory is a 26 second challenge. According to Darwin's Theory of Evolution, all living things are in a struggle to survive and to continue their lineage. It is not those who are stronger or smarter, but those who can best adapt to their environment, who survive. In addition, this genetic advantage continues to strengthen in other generations.

There are certain rules for creating a chemical substance. By using precise measurements, we can obtain the chemical substance we want by performing certain operations correctly. But things change when it comes to cooking. Some people are better cooks. It is said that the setting of his hand is very good. While cooking, measure is used, but there is also an abstract concept called judgment. People are not born with the mindset to rationally measure risks and returns. While those who open a demo account and speculate can be successful when there is nothing to lose, these basic instincts underlie their failure when they start speculating with real money.

Human nature has an urge to belong to a community. The saying that the wolf grabs the one who leaves the herd also indicates this. As investors constantly follow the news, comments and the movements of the index in the market, they begin to be affected by the comments.

"I can!"

Some people are overconfident and take too much risk when investing. Although experts advise against using high leverage ratios, the demand for high leverage ratios continues. In his blog "Big Picture", Barry Ritholtz describes how a man who was afraid to get on a plane was speeding through the streets on a Harley without a helmet. This person trusts his own ability more than the skill and knowledge of the pilot who has been trained to fly for many years. The confidence that our ancestors had in hunting large mammoths and maintaining their lineage is not very useful when investing. That's why a balanced psychology is the key to everything when investing in binary options at Exbina.